1. The good news in Lansing is that there’s a future for the power plant, though not as a power plant. The former coal plant would be reconfigured into a data center powered by renewable energy. Data centers use a lot of energy and have heavy energy loads, so old power plants are surprisingly suitable choices. The center’s computing power would demand about 100 megawatts at full capacity, according to reports, roughly equivalent to the power demand of 75,000 homes. They also produce large amounts of heat, so having a cold water intake from the lake comes in handy for supplying cooling systems. 15 megawatts would be produced on site, and the rest from off-site solar arrays. According to the Cayuga Operating Company’s memo, the conversion would provide $100 million in capital investments, 30 to 40 full-time jobs in the $40-60,000 range, as well as about 100 construction jobs.

In an interesting twist, the other plant slated to become a data center, in the town of Somerset in Niagara County, was the “Plan B” plant built after years or local protests and stonewalling shelved plans for a nuclear power plant in the town of Lansing near the Cayuga plant. The discovery of an ancient fault line near the Somerset site led to the operating company switching out its nuclear plans for coal. Suffice it to say, this data center plans also nullifies the plan to convert the power plant to a natural gas-fired facility.

While it’s a lower number of permanent jobs than the power plant (which was around 70 staff in 2016), it does provide a viable future for the town of Lansing’s biggest taxpayer, and comes as something of a relief in that regard. The county supports the proposal but the town is tabling support at the moment at the insistence of its Democratic bloc, which wants to ask questions at an informational meeting Wednesday before offering a voice of support. The state is not likely to support the plan unless the town has voiced support, so the vote is a rather urgent matter. It’s a bit tricky due to public notice guidelines, but the town board will hold a special meeting right after the presentation to vote on whether or not to support the plan.

For the record, the informational meeting is open to the general public – Lansing Town Hall at 29 Auburn Road, 6 PM Wednesday 6/26.

2. The bad news in Lansing is that the Lansing Meadows senior housing is in limbo. Unsurprisingly, the requested change from 20 to 30 units was considered a major change to the Planned Development Area. Developer Eric Goetzmann’s argument is that the 20-unit proposal proved too costly to build, and is seeking 30 units on roughly similar footprints. No dice, the IDA and village planning board would have to reopen their process to approve the changes, and the project is legally bound to be completed by the end of next July; another few months of review would cause it to miss that deadline.

Then came the latest proposal. Twelve units (four triplexes), just as originally intended when first proposed nine years ago. But the plan is clearly designed to be filled out with more units, the U.S. Army Corps of Engineers permits that required years to obtain have been left to expire. This too, would be a major change to the PDA, which is 20 units in 10 duplexes. A minor change would be shifting garages or marginal adjustments to building footprints. This is not minor.

This project has been before the planning board 57 times over the years and nine iterations. The village and the IDA have been very accommodating, from the unusual retail-building abatement for BJ’s, to the commercial space on the eastern end of the parcel, and all the residential changes over the years. I will be the first to acknowledge that some of the communities, Lansing village included, can be bureaucratically burdensome. But it’s time to point out that this developer is acting in bad faith. The village and the IDA have tried to make this work, bending over backwards to accommodate Goetzmann. He did not hesitate to get BJ’s built, which he sold in 2015 for a healthy $16.8 million. But the housing and the wetlands protection have always been afterthoughts, boxes checked in an effort to get that BJ’s abatement. It’s time that the village and IDA put their feet down and demand he either start building, or start making plans to pay back his tax abatement. The years of dickering have gone on long enough.

The concern is that by pursuing a clawback, the housing may never happen. But honestly, nine years on, is there an expectation that it will ever get done?

3. Sticking with bad faith for the moment – the IAWWTF proposal creates some uncomfortable questions. The first proposal was everything within a 1200 foot radius of the plant. The new one is everything west of Route 13 within that 1200 foot radius.

That doesn’t logically make sense. the prevailing wind direction for the offensive odors that the disclosure ordinance seeks to inform buyers and renters about? It’s NW-SE, due to a combination of storm tracks and the local topography, the hills create a channeling effect. Most of the areas covered under the new bounds aren’t in the downstream path of the winds, and odors carried by those winds.

Why were the established neighborhoods to the southeast of the plant left out, even if they are in one of the more prone locations? Officially, “because they’re already aware of the risks”, according to the explanation provided by the councilor spearheading the ordinance proposal, West Hill’s Cynthia Brock. That explanation neglects the fact that over time, tenants move and homeowners sell. As proposed, the cutoff is an excuse because existing homeowners in Fall Creek and Northside would have likely seen their home values and rental prices take a hit from her mandatory disclosure document, which another councilor described as “terrifying”. It would quickly lead to a lawsuit and the perception that Common Council is actively undermining the home equity and financial well-being of working class Northsiders and politically active Creekers. No other councilor on the committee would likely support the proposal in those circumstances.

So what does the IAWWTF disclosure ordinance impact as currently proposed? The revised version targets the Carpenter Park property, City Harbor, the NYS DOT site the county wants to have developed, the Farmer’s Market and a few other waterfront and near-waterfront properties. In general, mixed-use developments or potential developments that councilor Brock has regularly spoken out against.

This is being carried out on the auspices of health and welfare concerns, but as designed, the IAWWTF disclosure ordinance doesn’t adequately protect health and welfare, and appears to explicitly target waterfront projects councilor Brock dislikes. How would this withstand the inevitable lawsuit filed by either the City Harbor developers, the Carpenter Park development group, or the county?

Literally and figuratively, this doesn’t pass the smell test.

4. Here’s a look at the Planning and Development Board agenda for next Tuesday. Apart from a one-lot subdivision for a new home at 243 Cliff Street, everything else is a familiar item:

AGENDA ITEM

1. Agenda Review 6:00

2. Privilege of the Floor 6:05

3. Approval of Minutes: May 28, 2019 6:20

4. Subdivision Review

Project: Minor Subdivision and Construction of a Single Family Home 6:25

Location: 243 Cliff Street

Applicant: Laurel Hart & Dave Nutter

Actions: Declaration of Lead Agency, Public Hearing, Determination of Environmental Significance

Project Description: The applicant proposes to subdivide the .36 acre site into two parcels and build one single family home. The subdivision will result in Parcel A measuring .152 acres (6,638 SF) with 66 feet of frontage on Cliff Street and containing an existing single family home and garage, and Parcel B measuring .218 acres (9,484 SF) with 97 feet of frontage on Park Road. The property is in the R-3a Zoning District, which has the following minimum requirements: 5,000 SF lot size and 40 feet of street frontage for single-family homes, 10-foot front yard, and 10- and five foot side yards and a rear yard of 20% or 50 feet, but not less than 20 feet. Access to the proposed home on Parcel B will be via a new access drive connecting to Park Road. This has been determined to be a Type 1 Action under the City of Ithaca Environmental Quality Review Ordinance §176-4(B)(2), and the State Environmental Quality Review Act (“SEQRA”) §617.4(b)(11).

Project materials are available for download from the City website:

https://www.cityofithaca.org/DocumentCenter/Index/1028 (Site Plan Review)

https://www.cityofithaca.org/DocumentCenter/Index/1030 (Subdivision)

The property owners want to build a new home that will allow them to age in place; their current century-old home isn’t adaptable for the wheelchair accessibility they seek, but they want to stay in their neighborhood, so the plan is to work with local homebuilder Carina Construction to build a new modular unit (2 floors + partially built-out basement, 26’x28′ footprint) on a subdivided piece of their land. It’s a multistory home, but the upstairs can be converted into a unit for a live-in caretaker, and all their living needs can be handled on one floor. The home will be solar-powered. The new home, downslope from the existing house, will be accessed from Park Road.

5. Site Plan Review

A. Project: North Campus Residential Expansion (NCRE) 6:45

Location: Cornell University Campus

Applicant: Trowbridge Wolf Michaels for Cornell University

Actions: Consideration of Final Site Plan Approval

Project Description: The applicant proposes to construct two residential complexes (one for sophomores and the other for freshmen) on two sites on North Campus. The sophomore site will have four residential buildings with 800 new beds and associated program space totaling 299,900 SF and a 1,200-seat, 66,300 SF dining facility. The sophomore site is mainly in the City of Ithaca with a small portion in the Village of Cayuga Heights; however, all buildings are in the City. The freshman site will have three new residential buildings (each spanning the City and Town line) with a total of 401,200 SF and 1,200 new beds and associated program space – 223,400 of which is in the City, and 177,800 of which is in the Town. The buildings will be between two and six stories using a modern aesthetic. The project is in three zoning districts: the U-I zoning district in the City in which the proposed five stories and 55 feet are allowed; the Low Density Residential District (LDR) in the Town which allows for the proposed two-story residence halls (with a special permit); and the Multiple Housing District within Cayuga Heights in which no buildings are proposed. This has been determined to be a Type I Action under the City of Ithaca Environmental Quality Review Ordinance (“CEQRO”) §176-4 B.(1)(b), (h) 4, (i) and (n) and the State Environmental Quality Review Act (“SEQRA”) § 617.4 (b)(5)(iii) for which the Lead Agency issued a Negative Declaration on December 18, 2018 and granted Preliminary Site Plan Approval to the project on March 26, 2019.

Project materials are available for download from the City website: http://www.cityofithaca.org/DocumentCenter/Index/811

Cornell’s 2,079-bed North Campus Residential Expansion looks ready for final approval. Apart from some details regarding the planting plan and rooftop fans, there are no changes to report. Cornell would start construction shortly after approval is granted, with the first phase (sophomore housing, west/left) ready by August 2020, and the second phase (freshman housing, east/right) complete by August 2021.

B. Project: Arthaus on Cherry Street 7:05

Location: 130 Cherry Street

Applicant: Whitham Planning & Design

Actions: Consideration of Amended Negative Declaration of Environmental Significance, Potential Consideration of Preliminary & Final Site Plan Approval

Project Description: The applicant proposes an as-of-right five-story building approximately 63 feet of height with gallery, office and affordable residential space at 130 Cherry Street, on the east side of the Cayuga Inlet. The site is currently the location of AJ Foreign Auto. The program includes ground floor covered parking for approximately 52 vehicles, plus 7,000 SF of potential retail/office and amenity space geared towards artists’ needs. Building levels two through five will house approximately 120 studio, one-bedroom and two-bedroom residential units. The total building square footage is 97,500 SF. All residential rental units will be restricted to renters earning 50 to 80 percent of the Area Median Income. The north edge of the property will include a publicly-accessible path leading to an inlet overlook. This has been determined to be a Type 1 Action under the City of Ithaca Environmental Quality Review Ordinance § 176-4B(1)(k), (h)[2], (n), and the State Environmental Quality Review Act (“SEQRA”) § 617.4(b)(11).

Project materials are available for download from the City website: https://www.cityofithaca.org/DocumentCenter/Index/946

Project approval was delayed by a month because the city wanted to make sure that the Weitsman scrap metal facility wouldn’t pose any air quality risks. In a letter to the city, the firm doing the environmental work says the did some outreach to Ben Weitsman, and the Ithaca facility doesn’t do many of the processing, it just collects, sorts and transports the scrap metal out to other sites. Also, Weitsman states the facility will be be closing soon – it’s been rumored for a while that another mixed-use project in the works for the Weitsman site.

C. Project: Student Housing 7:25

Location: 815 S. Aurora Street

Applicant: Stream Collaborative, Noah Demarest for Project Sponsors Todd Fox & Charlie O’Connor

Actions: Project Updates, Review of FEAF Part 3

Project Description: The project applicant proposes a new 49-unit student housing complex (16,700 SF footprint) comprised of three buildings constructed on a hillside on the east side of Route 96B, overlooking the proposed Chain Works District. The proposed buildings will contain (2) efficiency units, (3) one-bedroom units, (10) two-bedroom units, (20) three-bedroom units and (14) four-bedroom units. Amenities will include a gym and media room, with access to an outdoor amenity space on the first floor of Building B, and a roof terrace and lounge on the fourth floor of Building B. The project site shares the 2.85 acre site with an existing cell tower facility, garages, an office and a one-bedroom apartment. Site improvements will include walkways and curb cuts to be tied into a public sidewalk proposed by the Town of Ithaca. Fire truck access is proposed at the existing site entry at the south end of the property, with a new fire lane to be constructed in front of the ends of buildings A & B at the northern end of the site. The project will include 68 parking spaces, as required by zoning. The property located in the R-3b zoning district. A variance will likely be required for a rear yard setback deficiency. This has been determined to be a Type 1 Action under the City of Ithaca Environmental Quality Review Ordinance §176-4(B)(1)(k), (n), (B)(2), and the State Environmental Quality Review Act (“SEQRA”) §617.4(b)(11).

Project materials are available for download from the City website: https://www.cityofithaca.org/DocumentCenter/Index/982

At the last meeting, the board and the city planning director had issues with the facade materials and that given the small size of the units, the project was “too focused on profit” (generally it’s not a good idea to make these comments because of their subjective nature, but here they were qualified with the concerns over facade material and unit size). In the updated submission document, the design stays the same, and it’s not clear if the materials were updated. It does not appear the unit sizes were changed.

D. Project: Commercial Building – 3,450 SF 7:45

Location: 410 Elmira Road

Applicant: PW Campbell for Visions Credit Union

Actions: Project Presentation, Declaration of Lead Agency

Project Description: The applicant proposes to construct a 3,450 SF commercial building with a drive-through, parking area for 20 cars, a 940 SF amphitheater, and associated site improvements on the 1.56 acre project site. The site is currently vacant. The project site is in the SW-3 Zoning district and will likely require an area variance. The project is subject to the Southwest Area Design Guidelines. This has been determined to be a Type 1 Action under the City of Ithaca Environmental Quality Review Ordinance §176-4(B)(2), and the State Environmental Quality Review Act (“SEQRA”) §617.4(b)(11).

Project materials are available for download from the City website: https://www.cityofithaca.org/DocumentCenter/Index/1019

This is the Visions Federal Credit Union branch proposal. Generally, the public reaction has been favorable to the plan, which includes an amphitheater for outdoor shows and events. The Voice article about the project is here.

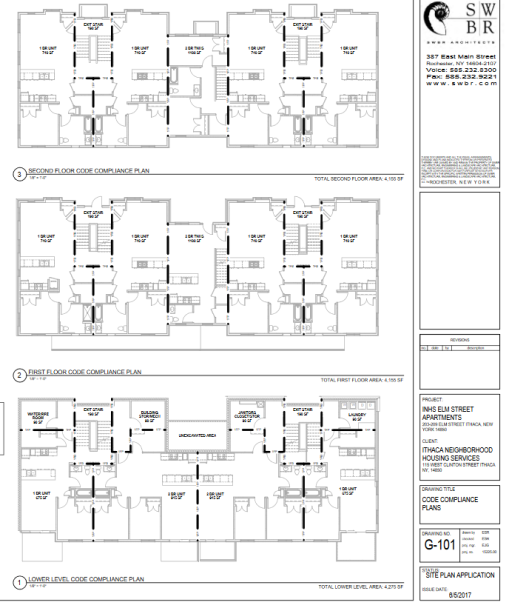

E. Project: Immaculate Conception Redevelopment Project (Mixed Use Housing) 8:00

Location: 320 W Buffalo Street

Applicant: Ithaca Neighborhood Housing Services Actions: Project Presentation, Declaration of Lead Agency

Project Description: The project involves the renovation/conversion of the existing two-story former school building into a mixed-use building with a two-story addition along North Plain Street, a new four-story apartment building, (2) three-unit townhome buildings, (1) four-unit townhome building, the renovation/conversion of a single family home into a two-family home, and the renovation of the “Catholic Charities” Building. The overall project will contain 78 dwelling units with 127 bedrooms. Total increase in square footage on the site will be 49,389 SF, from 62,358 to 111,747 SF. 9,274 SF of new and existing space in the former school will be commercial use. Site development will require demolition of one wing of the existing school building and one single-family home. The project also includes greenspace areas, 45 surface parking spaces, and other site amenities. The property is located in the R-2b zoning district; however the applicant has applied to Common Council for a Planned Unit Development (PUD). This has been determined to be a Type 1 Action under the City of Ithaca Environmental Quality Review Ordinance §176-4(B)(1)(k), (n), (B)(6), and the State Environmental Quality Review Act (“SEQRA”) §617.4(b)(11).

Project materials are available for download from the City website: https://www.cityofithaca.org/DocumentCenter/Index/1016

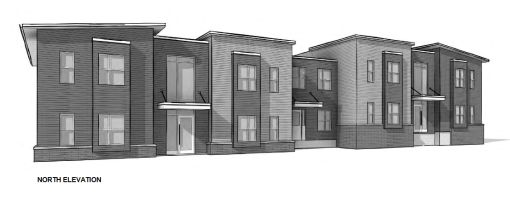

INHS’s $25.3 million redevelopment of the Immaculate Conception School has had some design tweaks, but the general site program remains the same. The Planning Board will be seeking answers regarding energy use/sources, pile driving, and aesthetic impacts on the neighborhood/consistency with neighborhood architectural character.

F. Project: Carpenter Circle Project 8:20

Location: Carpenter Park Road

Applicant: Andrew Bodewes for Park Grove Realty LLC

Actions: Project Presentation, Declaration of Lead Agency

Project Description: The project seeks to develop the existing 8.7-acre vacant parcel located adjacent to Route 13 and off of Third Street. The proposal includes a 64,000 SF medical office; two mixed-use buildings, which will include ground-level retail/restaurant/commercial uses of 23,810 SF, interior parking, 166 market-rate apartment units, and 4,652 SF of amenity space; and a residential building offering +/-42 residential units for residents earning 50-60% AMI. Site amenities will include public spaces for residents and visitors, bike parking, transit access for TCAT, open green space, a playground, and access to the Ithaca Community Gardens. The project includes 400 surface parking spaces and an internal road network with sidewalks and street trees. The project sponsor is seeking a Break in Access from NYS DOT to install an access road off of Rte 13. The property is located in the Market District; however, the applicant has applied to Common Council for a Planned Unit Development (PUD). The project will require subdivision to separate each program element. This has been determined to be a Type 1 Action under the City of Ithaca Environmental Quality Review Ordinance §1764(B)(1)(d), (i), (k), and (B)(6) and (8)(a) and the State Environmental Quality Review Act (“SEQRA”) §617.4(b)(11).

Project materials are available for download from the City website: https://www.cityofithaca.org/DocumentCenter/Index/1014

Interesting note from Part 1 of the Full Environmental Assessment Form (FEAF) – the phased buildout. Phase one is Cayuga Medical Center’s new office building. It would start construction in the fall and be completed in Spring 2021. The mixed-use building would begin construction the winter of 2019-20 and take about 20 months complete (so, a summer/fall 2021 timeframe). The affordable housing is phase three, and contigent on an affordable housing grant from the state. Once awarded, it would take about a year to build out.

The updated site plan indicates more tree plantings throughout the site, and the addition of a playground and plaza next to the affordable housing structure on the northern end of the site.

5. Old/New Business: July PRC, PRC Meeting start time 9:00

6. Reports 9:10

A. Planning Board Chair

B. BPW Liaison

C. Director of Planning & Development

7 Adjournment 9:30