Here’s a look at the agenda for the city of Ithaca Planning and Development Board meeting this month. It’s a week earlier than usual due to the Christmas holiday. Notes and comments in italics below.

1. Agenda Review 6:00

2. Special Order of Business – Presentation of the Greater Southside Plan 6:05

3. Privilege of the Floor 6:20

4. Approval of Minutes: November 27, 2018 6:35

5 Special Permits 6:40

A. Project: Bed & Breakfast Special Permit

Location: 130 Coddington Road

Applicant: Noah Demarest

Actions: Declaration of Lead Agency, Public Hearing, Determination of Environmental Significance, Potential Consideration of Special Permit Approval

Project Description: The applicant is seeking a Special Permit for use of the property as a homeowner occupied Bed and Breakfast. The property was originally issued a Special Permit in 1998 for operation of the five bedroom home as a homeowner occupied Bed and Breakfast; the Special Permit was not renewed in 2003, as required by §325-9c(4)(g)[3], and has therefore expired. During a recent home inspection, it was discovered the property had continued to operate absent a Special Permit, necessitating a new Special Permit application. No physical alterations to the building or the site are proposed. Issuance of a Special Permit is an Unlisted Action under the City of Ithaca Environmental Quality Review Ordinance (“CEQRO”) and the State Environmental Quality Review Act “(“SEQRA”)

This is a simple case of where the previous owner never renewed the five-year permit and didn’t tell the new buyer, who planned to continue using the home as a live-in Bed & Breakfast. No letters of opposition are on file. Approval, with the proper completion of all necessary forms, is likely to be straightforward.

B. Project: Bed & Breakfast Home Special Permit 6:50

Location: 2 Fountain Place

Applicant: Jason K Demarest

Actions: Declaration of Lead Agency, Public Hearing, Determination of Environmental Significance, Potential Consideration of Special Permit Approval

Project Description: The applicant is seeking a Special Permit to operate the existing 4,492 SF nine (9) bedroom residence located at 2 Fountain Place as a Bed and Breakfast Home. The owner is proposing to utilize four (4) of the nine (9) bedrooms as guest bedrooms for a period not to exceed 21 consecutive days, with a fifth bedroom utilized for home-owner occupancy. Guest occupancy will be limited to two persons or one family per guestroom. No exterior modifications are proposed to the existing home to establish the B&B use, and the existing house is compatible with the character of the neighborhood. Existing parking for seven (7) vehicles exists in the turnaround off Willets Place. The applicant does not propose cooking facilities in the guestrooms, and food service is to be limited to guests of the B&B. No other B&B Homes exist within 500 feet of the property. One sign that is five (5) SF maximum in area and not self-illuminated will be installed in compliance with Chapter 272 of the City Code, “Signs.”

Under city zoning code, B&Bs, which are to be owner-occupied, are allowed to four bedrooms to be used for the guests. A zoning code variance to use eight bedrooms as guest occupancy seemed unlikely, but the new owners believe the B&B may still be viable. Local architect Jason K. Demarest (brother of STREAM’s principal architect, Noah Demarest) is known for his historic restorations and historically-inspired design work, so his involvement is auspicious for those who hope that the century-old mansion and former Ithaca College president’s house retains its character.

6 Site Plan Review

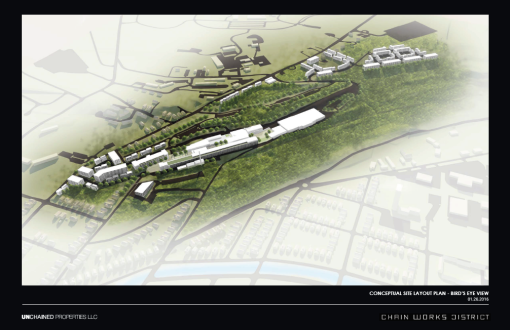

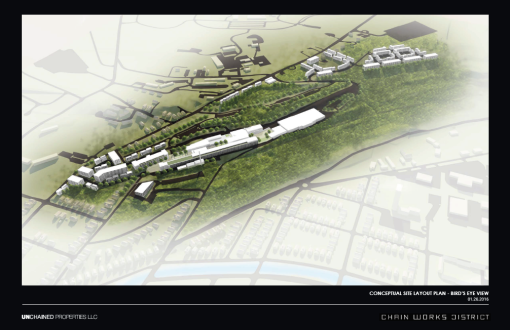

A. Project: Chain Works District Redevelopment Plan (FGEIS) 7:00

Location: 620 S. Aurora St.

Applicant: Jamie Gensel for David Lubin of Unchained Properties

Actions: Review FGEIS & Town Comments – No Action

Project Description: The proposed Chain Works District seeks to redevelop and rehabilitate the +/-800,000 sf former Morse Chain/Emerson Power Transmission facility, located on a 95-acre parcel traversing the City and Town of Ithaca’s municipal boundary. The applicant has applied for a Planned Unit Development (PUD) for development of a mixed-use district, which includes residential, commercial, office, and manufacturing. The site’s redevelopment would bridge South Hill and Downtown Ithaca, the Town and the City of Ithaca, by providing multiple intermodal access routes including a highly-desired trail connection. The project will be completed in multiple phases over a period of several years with the initial phases involving the redevelopment of the existing structures. Current redevelopment of this property will focus on retrofitting existing buildings and infrastructure for new uses. Using the existing structures, residential, commercial, studio workspaces, and office development are proposed to be predominantly within the City of Ithaca, while manufacturing will be within both the Town and City of Ithaca. Project materials are available for download from the City website: http://www.cityofithaca.org/DocumentCenter/Index/119

Hey, they’re starting to include documentation links in the agenda descriptions now! Most of the town’s comments are minor modifications and a possible correction on one of the traffic lane analyses. There’s a boatload of paperwork to dig through, so this meeting is just a chance for the planning board to look at the town’s comments, digest some of the supplemental files, and make sure there are no red flags or major concerns within that subset of information.

B. Project: North Campus Residential Expansion (NCRE) 7:20

Location: Cornell University Campus

Applicant: Trowbridge Wolf Michaels for Cornell University

Actions: Determination of Environmental Significance

Project Description: The applicant proposes to construct two residential complexes (one for sophomores and the other for freshmen) on two sites on North Campus. The sophomore site will have four residential buildings with 800 new beds and associated program space totaling 299,900 SF and a 59,700 SF, 1,200-seat, dining facility. The sophomore site is mainly in the City of Ithaca with a small portion in the Village of Cayuga Heights; however, all buildings are in the City. The freshman site will have three new residential buildings (each spanning the City and Town line) with a total of 401,200 SF and 1,200 new beds and associated program space – 223,400 of which is in the City, and 177,800 of which is in the Town. The buildings will be between two and six stories using a modern aesthetic. The project is in three zoning districts: the U-I zoning district in the City in which the proposed five stories and 55 feet are allowed; the Low Density Residential District (LDR) in the Town which allows for the proposed two-story residence halls (with a special permit); and the Multiple Housing District within Cayuga Heights in which no buildings are proposed. This has been determined to be a Type I Action under the City of Ithaca Environmental Quality Review Ordinance (“CEQRO”) §176-4 B.(1)(b), (h) 4, (i) and (n) and the State Environmental Quality Review Act (“SEQRA”) § 617.4 (b)(5)(iii). Project materials are available for download from the City website: http://www.cityofithaca.org/DocumentCenter/Index/811

This is likely to be the most contentious part of the meeting. The planning staff have conducted their analysis. Some traffic mitigation measures are sought, including circulation and mass transit / multi-modal transit improvements. The city will make sewer system upgrades a stipulation of project approval, and being next to the Cornell Heights Historic District, the board as Lead Agency wants a more sensitive use of materials and material colors, and extensive vegetative screening to be reviewed further before approval. But the most debated component, the energy use impacts, the city feels is effectively mitigated through the proposed measures by the applicant team.

I’m going to raise one point of correction though – the number of beds is going up to 2,079, but the planning staff should note that a campus-owned fraternity house, the former Sigma Alpha Mu building at 10 Sisson Place (the chapter moved to 122 McGraw Place), is coming down to make way for the project, so the gross number of beds is at least 30 less that that figure.

C. Project: Falls Park Apartments (74 Units) 7:50

Location: 121-125 Lake Street

Applicant: IFR Development LLC

Actions: Review of FEAF Part 3 – No Action

Project Description: The applicant proposes to build a 133,000 GSF, four-story apartment building and associated site improvements on the former Gun Hill Factory site. The 74-unit, age-restricted apartment building will be a mix of one- and two-bedroom units and will include 7,440 SF of amenity space and 85 parking spaces (20 surface spaces and 65 covered spaces under the building). Site improvements include an eight-foot wide public walkway located within the dedicated open space on adjacent City Property (as required per agreements established between the City and the property owner in 2007) and is to be constructed by the project sponsor. The project site is currently in the New York State Brownfield Cleanup Program (BCP). Before site development can occur, the applicant is required to remediate the site based on soil cleanup objectives for restricted residential use. A remedial investigation (RI) was recently completed at the site and was submitted to NYSDEC in August 2018. The project is in the R-3a Zoning District and requires multiple variances. This is a Type I Action under the City of Ithaca Environmental Quality Review Ordinance (“CEQRO”) §176-4 B(1) (h)[2], (k) and (n) and the State Environmental Quality Review Act (“SEQRA”) §617-4 (b) (11). Project materials are available for download from the City website: http://www.cityofithaca.org/DocumentCenter/Index/852

Part III of FEAF is the city planner-written review of impacts, proposed mitigations, and whether the lead agency feels the mitigations are appropriate and effective. Some stormwater, remediation plan and other supplemental materials are still needed before a declaration of significance can be made.

D. Project: New Two-Family Dwellings 8:10

Location: 815-817 N Aurora

Applicant: Stavros Stavropoulos

Actions: Public Hearing

Project Description: The applicant proposes to demolish an existing two-family residential structure and construct two new 1,290 SF two-family dwellings on a 9,590 SF lot. The existing residential building is a legally non-conforming building with a side setback deficiency (2.9 feet instead of the required 5 feet). The proposed redevelopment will include four parking spaces for four three-bedroom apartments. The applicant is requesting the Board’s approval to use the landscaping compliance method for parking arrangement. The project site is located in the R-2b Zoning District and meets all applicable zoning lot and setback requirements. This is an Unlisted Action under the City of Ithaca Environmental Quality Review Ordinance (“CEQRO”) and the State Environmental Quality Review Act (“SEQRA”). Project materials are available for download from the City website: http://www.cityofithaca.org/DocumentCenter/Index/859

City staff were really unhappy about this plan last month, and it was implied that this was one of the examples of “bad” infill that may lead to the new single primary structure overlay. However, barring extreme circumstances (think Maguire at Carpenter Park), review will continue under the current regulations. No new materials appear to have been submitted since the last meeting.

E. Project: Maguire Ford Lincoln Additions and Improvements 8:30

Location: 370 Elmira Road

Applicant: John Snyder Architects PLLC

Actions: Public Hearing, Potential Determination of Environmental Significance

Project Description: The applicant proposes to demolish a portion of the existing building and construct two additions with updated exterior materials. The existing building is 18,500 GSF, with 2,265 GSF proposed for demolition. The new building will be 24,110 GSF. Site improvements include incorporation of a new pedestrian walking path, and site connections to Wegmans. Approximately 311 parking spaces are proposed to accommodate customer, service parking, employee, and display parking. The project site is located in the SW-2 Zone, is subject to the 2000 Southwest Design Guidelines, and will require a zoning variance for a front yard that exceeds the maximum permissible in the SW-2 district (34 feet maximum permitted, 69-feet 3-inch setback proposed). This is an Unlisted Action under the City of Ithaca Environmental Quality Review Ordinance (“CEQRO”) and the State Environmental Quality Review Act (“SEQRA”); however, it will be treated as a Type I Action for the purpose of environmental review. Project materials are available for download from the City website: http://www.cityofithaca.org/DocumentCenter/Index/860

The revised plans include modified architectural features (more windows, a green wall), and a greater amount of vegetated landscaping to comply with zoning. On-site solar panels are being considered per board recommendation, but the old building was not designed to hold the weight of solar panels. The new wings will be designed to host panels. Heat pumps are being evaluated for some functions, but some of the heavy-duty components like the service bay will likely rely on modified conventional fuel systems. The building will meet or exceed NYS Energy Code requirements.

F. West Hill- Tiny Timbers – Sketch Plan 8:50

This one has been a long time coming. Tiny Timbers bought a 5.45 acre parcel on the south end of Campbell Avenue’s 400 block back in September 2016, and has long planned one of its cluster home developments on the vacant lot. As noted at the time on the blog:

“Dolph et al. are looking to do a similar development to the one in Varna on a 5.45 acre parcel at the south end of the 400 Block of Campbell Avenue, which was noted in a weekly news roundup when it hit the market back for $195k in August 2015. The Journal’s Nick Reynolds touched on it in a through write-up he did earlier this week. The comprehensive plan calls this portion of West Hill low-density residential, less than 10 units per acre. Current zoning is R-1a, 10000 SF minimum lot size with mandatory off-street parking, although maybe a cluster subdivision would come into play here. The Varna property is a little over 6 units per acre. If one assumes a similar density to the Varna project, the ballpark is about 35 units, if sticking to the 10000 SF lot size, then 23 units.

On the one hand, expect some grumbling from neighbors who won’t be thrilled with development at the end of their dead-end street. On the other hand, these small houses are modestly-sized and priced, they’ll be owner-occupied, and if the Varna site is any indication, the landscaping and building design will be aesthetically pleasing.”

G. 112-114 Summit Ave – Sketch Plan 9:10

This one required some fact-checking, because 114 Summit Avenue was the former Cascadilla school dorm that came down last year to make way for the Lux apartment project at 232-236 Dryden Road. A better address for this project might be “238 Dryden”, and the rumor mill says it’s by Visum Development Group, who developed the Lux. Although the exact positioning seems uncertain, the parcel north of the Lux is CR-3 (three floors, 40% lot coverage, parking and houselike features such as gables and porches required), and the remaining adjoining parcels are CR-4 (four floors, 50% lot coverage, no parking required). With student housing experiencing a little more slack in the market lately, it’s not clear if this is student housing, or another use.

7. Old/New Business PRC Meeting Time/ Date 9:30

8. Reports

A. Planning Board Chair

B. BPW Liaison

C. Director of Planning & Development 9:40

9. Adjournment 9:50