Let’s start this off by taking the broader view. Climate change is real, and is increasingly harming our natural and built environments. In order to mitigate the worst of its effects and help ward off a potential global crisis, it is necessary to limit our environmental impacts. Building construction and urban planning is a major part of that, by using sustainable materials, construction practices, and following planning initiatives to limit the carbon footprint and wasted resources of older conventional approaches.

Ithaca and Tompkins County have approached this enthusiastically, though with mixed success. There is a robust environmental movement in the community, and many of them choose to practice what they preach, at least in their homes if perhaps not so much their site plans (case in point: Ecovillage, while well-designed structurally, is located so far from most goods and services and relies on vehicular travel and creates elevated infrastructure costs for installation and maintenance – in effect, “green sprawl”). Cornell Cooperative Extension maintains a database of local examples of sustainable housing.

One of the areas that has been severely lacking in truly sustainable housing, however, is the multi-family housing segment. The vast majority of eco-conscious housing built in Tompkins County is one-family or two-family. However, these are often on larger lots on the fringe of the urban boundaries of the Ithaca area. This has its limitations, not just the “green sprawl” issue, but affordability concerns related to land costs and single-family home construction costs. Given that it’s more environmentally efficient to invest in communities where infrastructure is in place and where goods and services allow for multiple transit options other than a car, it’s really crucial to demonstrate workable multi-family options, maximizing sustainability and demonstrating that it can be cost-efficient for a builder/developer to be green. But apart from a few examples like EcoVillage’s TREE apartment building, there are few local structures that really showcase what can be done these days with respect to sustainable building multi-family design and construction, especially in an urban setting.

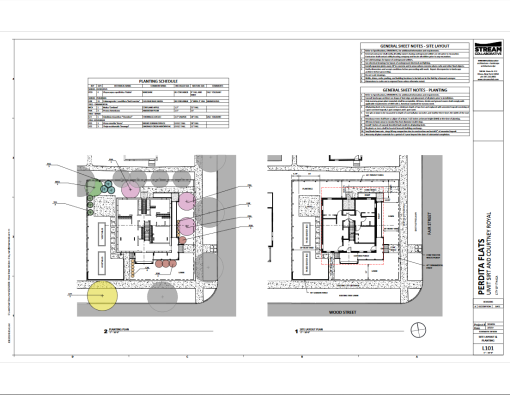

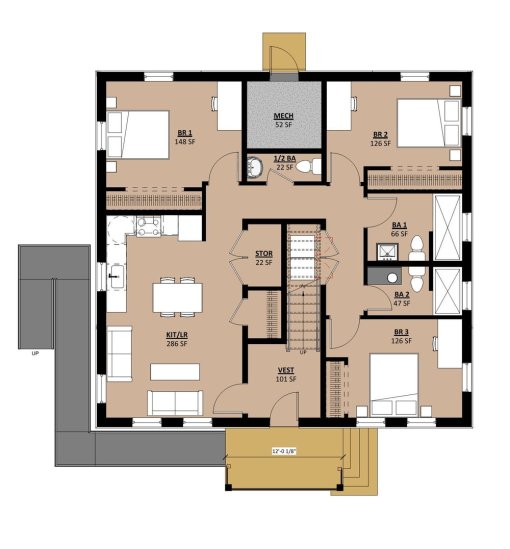

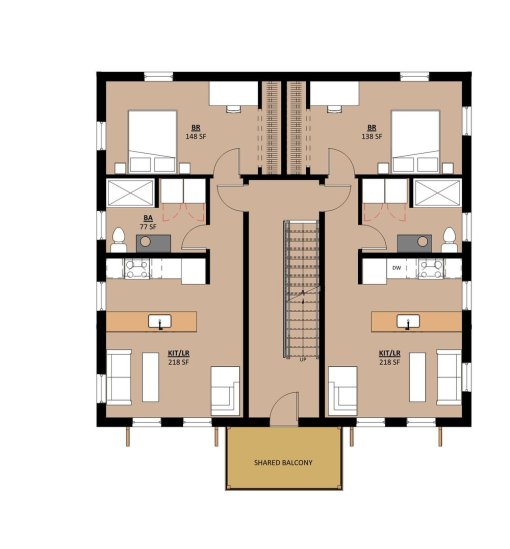

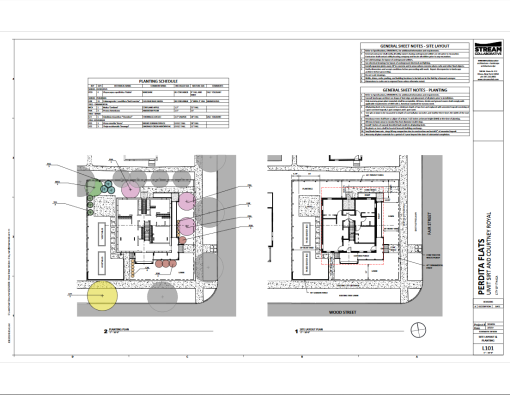

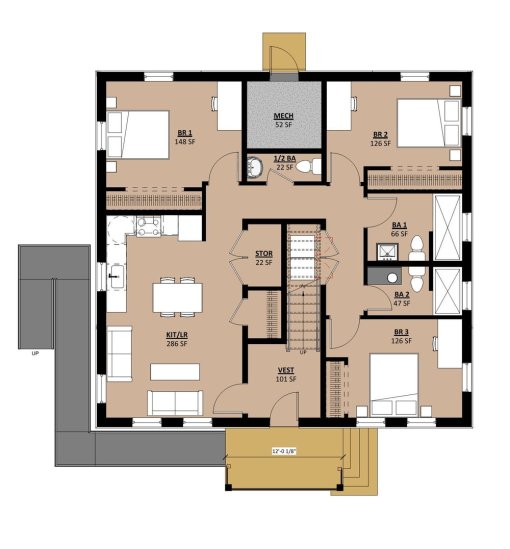

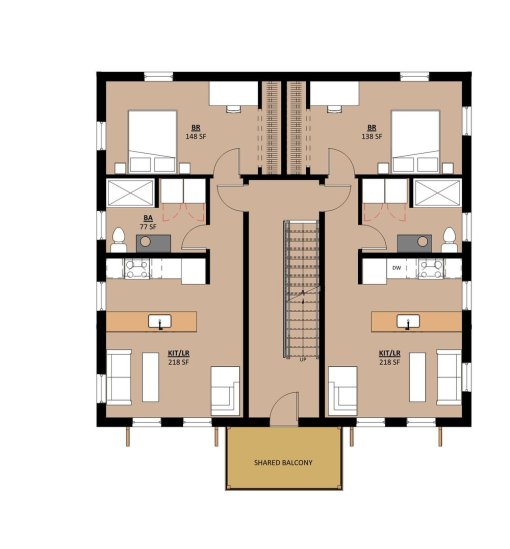

Perdita Flats is an attempt to show that it can be done. In scale, it’s nothing particularly impressive. The site is an undeveloped lot at 402 Wood / 224 Fair Street, previously a double-lot with the neighboring house at 404 Wood (in fact, I noted its development potential when the lot was subdivided). The building itself will be 3,524 SF, three stories with a total of four market-rate units on a 36′ x 36′ footprint with a wrap-around porch. There will be one three-bedroom unit, one two-bedroom unit and two one-bedroom units – in other words, “missing middle” infill, smaller multi-family of similar unit density to many inner ring urban neighborhoods. (Apparently, the three bedroom is being reduced to a two-bedroom, but this was a very recent change.)

The building, a work of local firm STREAM Collaborative, is designed to fit in with the older homes in the neighborhood by using visual elements like the porch and the gable roof. The exterior will be finished out in natural shiplap wood siding and black standing-seam metal siding.

Where the building really shines is with its sustainability features – this is a net-zero project, meaning that all the energy it uses is provided by renewable sources. Energy-efficient features include a rooftop solar array with on-site battery energy storage, simple square shape, super-insulated building envelope (double stud wood framing and triple-pane low-e fiberglass framed windows), maximized natural daylighting through window placement and light-reflective paint, high-efficiency appliances, plumbing and fixtures, air-source heat pumps, low-emissions and non-toxic natural materials and finishes, and rainwater harvesting. To put it in perspective, the Ithaca’s Green Building Policy in the works requires a score of six points for approval, and this project would earn 17 points. The landscaping will include a shared garden plot, new sidewalk, and native greenery.

The project is the work of Umit Sirt and Courtney Royal. The husband and wife pair are staff of Taitem Engineering, a local engineering consulting firm that specializes in energy efficiency and the use of alternative (renewable) energy sources in building projects. Putting that knowledge to use, the couple recently built a net-zero energy home for their family in Ulysses — net-zero meaning that all energy produced comes from on-site or nearby renewable resources.

To give a rough timeline, Royal and Sirt bought the land for $70,000 in June 2018. The Perdita Flats project was first proposed in February 2019 and approved in April. The project sought and received a zoning variance on parking, two spaces instead of the four required, to allow for the garden space, and a reduction in the rear year setback from 20 feet to 10 feet, to better accommodate the garden and solar panels. To those fretting about the parking deficiency, on-site bicycle storage is provided as part of the project, and the Fair Street location has easy access to both stores on Meadow Street, and to Downtown Ithaca. Apart from the occasional Carshare use, life without a car here would be plausible.

The site plan review document estimated the development costs at $520,000. NYSERDA, the state’s energy sustainability agency, awarded the project $70,560 as part of its Buildings of Excellence program. Instead of the traditional hazardous refrigerants used for the internal circulation within electric heat pumps, Perdita Flats will use a more advanced carbon dioxide-based system (yes, CO2 isn’t good in large quantities, but it’s much less harmful ounce-for-ounce than refrigerant). To quote the application, “(i)n virtually every way, this building will be an example of what is possible for new construction in terms of reduced energy use and a complete lack of reliance on fossil fuels.”

Royal and Sirt’s colleagues at Taitem Engineering helped with the mechanical and plumbing design. The construction manager will be Mike Carpenter, along with the developers themselves. In case you’re wondering, Perdita is “a mythological child who brought a love of the natural world to humans”, according to the project’s website. (At this time, the website is mostly bare except for the landing page.)

At the site, not much has happened yet, though it looks like some trees were cleared. A project of this modest scale should take a half year or less once ground is broken.