1. Matt Butler at the Times is providing an in-depth check-up on the mall this week. This was a story the Voice had laid groundwork for as well, so it’s nice that one of the local news orgs was able to make hay of it. The mall, like many middle-class local malls across the country has been struggling in the age of Amazon and the retail meltdown. The overall economy might be humming along, but retail closures continue to spike nationwide, with over 6,100 closures planned this year alone, more than the 5,900 announced in all of 2018. With planned new store openings numbering 2,100, it’s practically two stores closing for every one that opens. Retail mega-landlord Cushman and Wakefield estimates 9,000 stores will close in 2019, and over 12,000 in 2020. In the Ithaca Mall, Gertrude Hawk is gone, American Eagle closed up last year, Ultimate Athletics shut its doors, the Bon-Ton closed as part of the shutdown of the whole chain, and the Sears Hometown store is kaput. The mall’s manager cited a variety of reasons, including chain downsizing, poor performance, and some just stopped paying rent.

This has major economic impacts; the mall’s property value has declined by over 60% since the start of the decade, and the village, the county and the schools have to make up those hundreds of thousands of dollars in property tax revenue somewhere (and the county and schools have). County legislator Deborah Dawson, who represents the mall’s district, suggested doing something similar to the DeWitt Mall downtown, a mix of local businesses, but the mall is a much bigger space to fill (622,500 SF vs. 117,500 SF in the DeWitt Mall), and DeWitt Mall is mixed-use (retail and 45 apartments). Local businesses and experiential outlets can be part of the solution as Running 2 Places is showing with their 18,000 SF theater this spring, but it’s one component of a solution. Residential could be a component, but some legal and logistic issues would need to be sorted out, which owner Namdar Realty has never shown much interest in; the village has also been lukewarm to the idea. About 40 apartment units were floated for a section of the parking lot (west/on the backside of the mall if I remember right), but that idea died during the Great Recession.

There is so silver bullet here. The owner needs to be more proactive then holding a proverbial gun to its’ tenants heads in order to get them to stay. Local governing bodies also have to keep an open mind for redevelopment ideas – if parts of the mall were torn down and replaced with residential, for example. As it is, the only plans on the horizon are an unnamed tenant for the former Bon-Ton space, and the extended stay hotel planned for the parking lot behind (west) of the Ramada Inn. The future of the mall is hazy; like a species faced with a steadily changing habitat, it’s either adapt and evolve, or perish.

2. Courtesy of their Facebook page, here’s a sketch render of what Salt Point Brewing Compant’s new brewery and taproom would look like. It’s a fairly unobtrusive one-story structure with a gable roof and two wings, presumably the taller one for the brewing tanks and the smaller one for service functions. On the outside are wood accents and a two-story deck for outdoor drinking and possibly dining, if the restaurant option is pursued.

The building, as well as associated landscaping and parking improvements, would be located on about three of the five acres sold as Parcel “D” in the Lansing Town Center development. The remaining two acres are wetlands and would be left undisturbed. Salt Point paid $75,000 for the land, and will bring its project forth to the town planning board in the coming months. No word on any job creation figures yet.

3. The NYS DOT county facility plans are moving forward. The state bought its 15 acres from Tompkins County for $840,000 according to a deed filed on April 24th. The building is classified as a sub-residency facility, a step below a primary regional facility (the main office for Region 3 is in Syracuse).

To review, the plans consist of the 30,000 SF sub-residency maintenance building, a 5,000 SF Cold Storage unit, an 8,200 SF salt barn, and a 2,500 square foot hopper building (covered lean-to). The proposed maintenance building will have vehicle storage for 10 trucks, a loader and tow plow, with one additional double depth mechanical bay and single depth, drive-thru truck washing bay. It also includes an office area (three rooms), lunch/break room (30 people), toilet/shower/locker rooms, storage rooms and mechanical/electrical rooms. The site will also contain stockpile areas for pipe, stone and millings, and ancillary site features include parking for 40 vehicles, and stormwater management facilities. A new access drive will be constructed from Warren Road.

The town has been less than pleased with the project, which is not bound to zoning code because it’s a public resource facility owned and operated by a government entity. Rather than voice approval, the planning board voted to acknowledge that they simply had no authority to control the project. Some modifications were made to the plans at the town’s request, such as the fueling station being moved onto airport property across Warren Road, but neighbors are still unhappy that snowplows and heavy-duty maintenance vehicles are about to be their next door neighbors.

The facility is expected to be open by the end of the end of the year. Once all staff and equipment have been moved in, the county may pursue a request for proposals/request for expression of interest for the current DOT property on the shores of the inlet near the Farmer’s Market. A 2015 feasibility analysis found that the site could conceivably host a $40+ million mixed-use project, and the site has became more amenable towards redevelopment with the enhanced density and use provisions made to the city’s waterfront zoning in 2017.

4. The Ithaca city planning board granted a negative declaration of environmental review to the 124-unit Arthaus affordable housing project at 130 Cherry Street. According to my editor Kelsey O’Connor, the latest revisions propose a five-story building that would include a gallery, office and affordable rental space. It would include parking for about 36 vehicles and 7,600 square feet of potential retail or office and amenity space geared toward artists. All of the units would be restricted to renters earning 50 to 80% of the area median income, or about $30,000 to $45,000. The north end of the property will also include a publicly accessible path leading to the inlet.

Speaking in favor of the project were neighborhood business owners and non-profits, and in opposition was councilman George McGonigal, who said both in a letter and in person that it was too big for the site and threatened the industrial character of the neighborhood. They have bigger concerns than housing nearby. Cherry Street is difficult to access with large trucks and commercial vehicles, the Brindley Street and Cecil Malone Drive bridges are small and in poor shape. Secondly, Cherry Street doesn’t provide much room for operations to expand, so that hinders their long-term operational planning. It’s not just lot size, but also the soil – the Emmy’s Organics project fell through because of poor soil not amenable for warehouse and other light industrial functions that rely on a concrete slab. Thirdly, the city’s strict environmental laws, fees and higher property taxes make an urban site less appealing. They can get more land with a lighter tax burden in Lansing, Dryden, or any of the other outlying towns. With these issues in mind, many of the industrial businesses down there now aren’t looking to stick around. Several have already sold or made purchase options with developers as they seek areas with lower taxes, easier access to highways and less strict environmental ordinances.

The unanimous approval by the city planning board allows the project to move forward with consideration for preliminary approval. The goal is to gain approval at next month’s meeting, and once affordable housing funds have been secured, to start construction of the project, likely in December of this year.

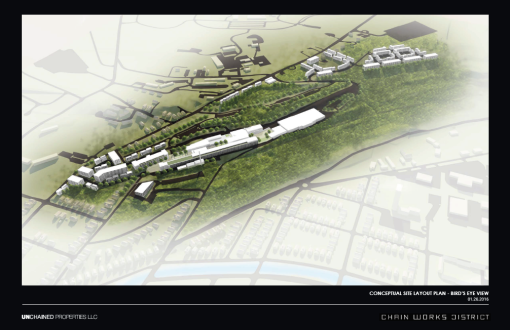

5. The Chain Works District presented plans for phase one at the Planning Board meeting. There are four buildings in phase one, of which two are in the city. 43,400 SF Building 21 would be renovated into a commercial office building. The work here is limited to replacing walled-up window openings with new windows, exterior cleaning and painting, and new signage and entrance canopies. Building 24 is a combination of renovation and expansion. The partially built-out basement and first floor would be renovated for commercial office space, the second and third story would be residential, and a new fourth floor would be built for residential uses, for a total of 135,450 SF across 4.5 floors. As with Building 21, new windows would be installed, and the exterior cleaned and painted. New landscaping, sidewalk and parking areas are also planned.

At a glance, the residential in the first phase would host 60 market-rate rental units. Each floor will have one studio unit, nine one-bedroom units, nine two-bedroom units, and one four-bedroom unit. According to the Site Plan Review document, the project would begin renovation in October, and be open by August 2020. The other two building in phase one are renovations of industrial and manufacturing spaces in the town, Buildings 33 and 34. These will retain industrial uses.

This meeting was only for the purpose of sharing and discussing plans, with no voting at this time. According to Edwin Viera at the Times, the board was reluctant to approve any plans without more information about who will be occupying them. That seems a bit odd, because projects are analyzed for their physical impacts, not the tenants, but the Times article says parking and landscaping may change slightly depending on the tenant. According to project representative Jamie Gensel, the USDA is considering renting out some of the office space. The USDA maintains a research facility inside the Holley Center on Cornell’s campus, and there were plans in the late 2000s to build an addition, which were later shelved during the Great Recession. It’s not clear how much space they’re seeking. Not sure what to make of that writeup, honestly, or being told to move the buildings into a different phase (personally, I’d like to be renovations before any new builds happen).

6. 815 South Aurora Street, aka “Overlook”, also continued its review at the planning board meeting. There were some minor design tweaks, seen in the before image (above) and after image (below). Changes in exterior colors, panels, ground-level entrances and fenestration, particularly on the side facing South Aurora Street. The fire trucks are to indicate that emergency vehicles will be able to safely pull in and out from the road. Overall, project size remains at 49 units and 141 bedrooms.

There’s been some pushback from neighbors regarding size and neighborhood character. There’s an argument that these are dependent on Chain Works, but that argument doesn’t pass the smell test – if Chain Works didn’t happen, fewer units on the South Hill market would make the project even more appealing to Visum Development and Modern Living Rentals. The planning department wants more geotechnical information and bedrock to be removed, details about the new planting and landscaping, and energy systems. Documents submitted indicate the all-residential development will use electric heat pumps. The board has requested a shadow study and flesh out the environmental impacts, which is a common request for larger developments.

7. At least one project is fully approved. Although it seems at least one planning board member asked for affordable housing, the four-unit market-rate Perdita Flats infill at 224 Fair Street was granted preliminary site plan approval. The project is intended to be a sustainable building showcase of eco-friendly features, a net-zero energy showcase of what can be done with environmentally sustainable multifamily housing. The owner/developers, Courtney Royal and Umit Sirt, will be applying for incentives from the NYSERDA Low-Rise Residential New Construction Program and are hoping to attain the Zero Carbon Petal of the Living Building Challenge.